Mortgage Blog

Getting you the mortgage you deserve

OFSI - New Stress Test Changes

January 10, 2025 | Posted by: Christopher Chanakos

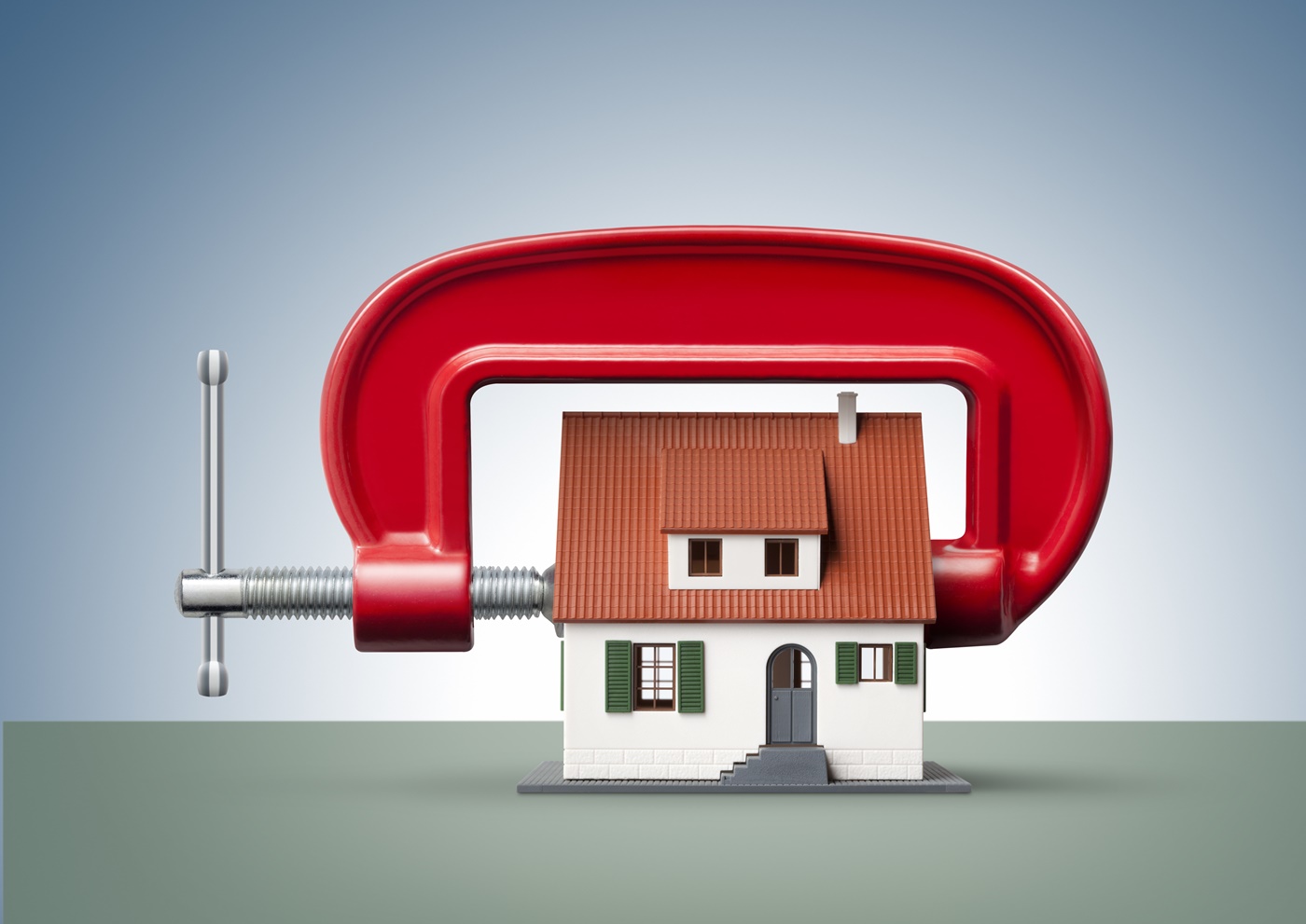

Did OFSI Drop the Ball?

In September, the Office of the Superintendent of Financial Institutions (OSFI) announced a significant policy change aimed at easing barriers for uninsured borrowers seeking better mortgage rates. Starting November 21, the mortgage stress test would no longer apply to uninsured straight mortgage switches, provided there was no increase in the loan amount or amortization.

The policy change eliminated the Minimum Qualifying Rate (MQR) requirement for these switches, allowing borrowers to transfer their mortgage from one lender to another without additional stress test hurdles.

However, just as the change was set to take effect, Assistant Superintendent Tolga Yalkin revealed an additional restriction that surprised many in the industry. During a Q&A session with stakeholders, Yalkin clarified that the new rule only applies to mortgages being transferred between federally regulated financial institutions (FRFIs).

This restriction is based on OSFI’s confidence in the underwriting standards of federally regulated institutions. Consequently, the stress test continues to apply to uninsured mortgages that are either originated by or transferred to non-federally regulated entities, such as provincially regulated credit unions and mortgage finance companies.

The unexpected scope of this restriction has caused confusion and frustration among industry professionals, particularly as it appears to contradict OSFI’s earlier guidance.

If your mortgage is up for remewal in 2025, now is the time to reach out and create a strategy.